Sales tax compliance is one of the most volatile issues that many businesses have to deal with, with more than 8,000 taxing jurisdictions across the country. From the state and county-level, to cities and special purpose zones like metro transit authorities.

Not only are there thousands of jurisdictions, but rates change frequently as temporary taxes expire or new ones are added. To make it even more challenging, many of these jurisdictions also offer “sales tax holidays” during certain times of the year to spur consumer spending and boost local sales. The most frequent of these are back-to-school tax holidays, where a varying array of products can be sales tax-exempt, from computers to clothes, for a few days preceding the school year.

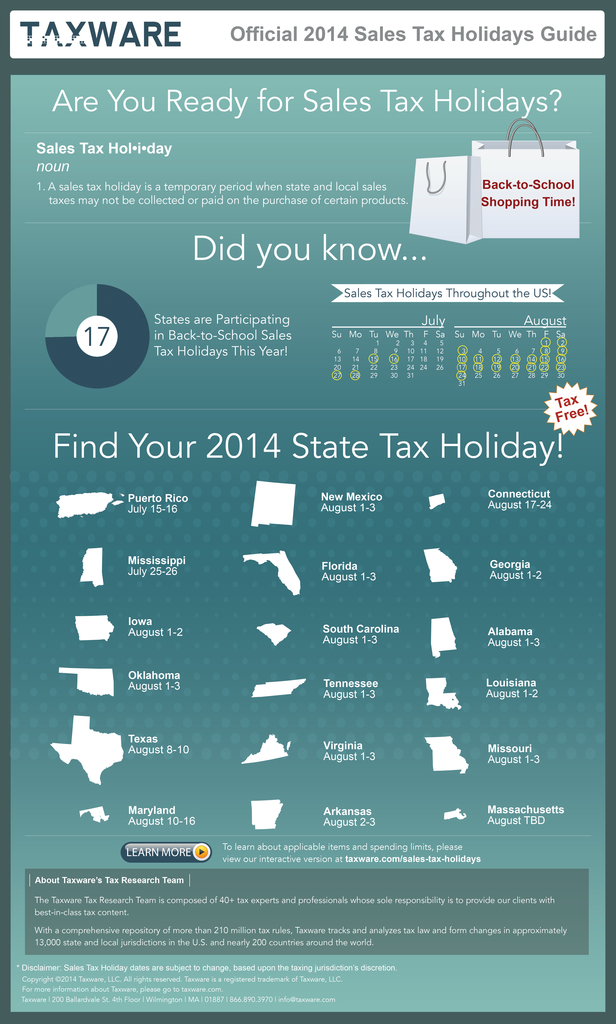

Fortunately, sales tax technology provider Taxware has released its 2014 List of State Sales Tax Holidays. The company keeps track of all of the jurisdictions across the U.S. to keep its software up-to-date for its business customers.

While some states and local taxing entities restrict the exemption to a few items and a $100 individual item price threshold, a few states offer virtually all-encompassing holidays with price thresholds as high as $2,500.

As they grow in number and in scope, Sales Tax Holidays continue to be an increasingly challenging issue for retailers of all sizes. Some holidays, such as the one in Massachusetts, are very broad and include virtually all types of tangible personal property sold to consumers, while other states, such as Connecticut, limit the tax break to clothing and footwear only.

With the numerous differences in criteria among the 17 states (and Puerto Rico) that participate in sales tax holidays, these events can be an administrative nightmare for retailers. Some states do not officially pass the legislation authorizing the holiday until just before it is scheduled to take effect. An argument can be made that last-minute holidays prevent the deferred purchasing phenomenon, but that is little consolation for retailers left scrambling to put together an advertising campaign and configure their cash registers.

For retailers, the burden associated with sales tax holiday administration can be enormous if they do not have a sales tax compliance management system in place. With sales tax holidays coming up, retailers will need to reset their cash registers or point-of-sale systems, customize their tax rates and remap their product SKUs. However, with a sales and use tax compliance partner, such as Taxware, retailers would simply need to apply the regularly-scheduled content updates to their system to produce a result consistent with the tax holiday.

An interactive infographic is available at taxware.com/sales-tax-holidays-infographic.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Sales Tax, State and Local Taxes, Technology